There are real neighborhood differences in the rate at which home mortgages were resold on the secondary market.

There is no doubt that information technology has brought about huge changes in world financial markets. Markets which used to be largely isolated are now inextricably interconnected by a real time network of transactions in which, generally, capital flows instantly to the highest bidder regardless of the location of that bidder on the globe. We might expect this trend, which Richard O’Brian calls this “the end of geography,” to be good news for low-income communities. One could conclude that the development of an integrated and standardized financial network, by reducing the role of potentially biased individual lenders, could reduce racial and income discrimination and move the economy toward a situation where capital is allocated based entirely on the real value which various sectors contribute. And yet low-income urban communities in America and elsewhere appear to be experiencing increasing capital shortages.

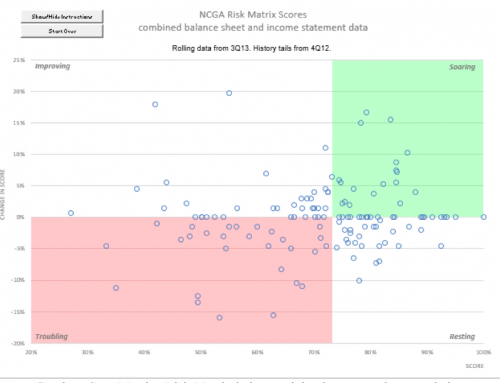

This paper identifies an emerging structural logic of the financial system under which investment decisions are made by a network that relies on previous transactions as the main source for information about credit quality. The home mortgage market in the United States is examined as a specific case of this more general global financial market transformation. Data relating to the secondary market for single family home mortgages in the Oakland, CA metropolitan area is employed to provide empirical support for the argument that the emerging financial network itself has distinct geographic preferences which place low-income and minority neighborhoods at a systematic disadvantage in the competition for capital.